9 Easy Facts About Clark Wealth Partners Explained

Table of ContentsSome Ideas on Clark Wealth Partners You Need To Know4 Easy Facts About Clark Wealth Partners ExplainedWhat Does Clark Wealth Partners Do?Clark Wealth Partners Can Be Fun For AnyoneClark Wealth Partners Can Be Fun For EveryoneEverything about Clark Wealth PartnersFacts About Clark Wealth Partners Revealed

These are specialists who offer financial investment suggestions and are signed up with the SEC or their state's safety and securities regulatory authority. NSSAs can help elders choose concerning their Social Safety and security advantages. Financial advisors can also specialize, such as in trainee car loans, senior requirements, tax obligations, insurance policy and other elements of your funds. The accreditations required for these specialties can vary.Only financial advisors whose classification requires a fiduciary dutylike licensed economic coordinators, for instancecan claim the very same. This difference likewise suggests that fiduciary and monetary expert cost structures differ too.

Little Known Facts About Clark Wealth Partners.

If they are fee-only, they're extra most likely to be a fiduciary. Many credentials and designations require a fiduciary duty.

Picking a fiduciary will certainly guarantee you aren't steered toward certain financial investments because of the commission they use - financial company st louis. With great deals of money on the line, you might desire a monetary expert who is legally bound to use those funds thoroughly and only in your best interests. Non-fiduciaries may recommend financial investment items that are best for their pocketbooks and not your investing goals

What Does Clark Wealth Partners Do?

Increase in cost savings the typical family saw that functioned with a monetary advisor for 15 years or even more compared to a similar house without an economic advisor. "A lot more on the Worth of Financial Advisors," CIRANO Project Reports 2020rp-04, CIRANO.

Financial advice can be helpful at transforming factors in your life. Like when you're beginning a family, being retrenched, planning for retirement or taking care of an inheritance. When you consult with an adviser for the very first time, function out what you wish to get from the recommendations. Before they make any recommendations, an advisor must put in the time to review what is very important to you.

The Ultimate Guide To Clark Wealth Partners

Once you've accepted go on, your economic advisor will prepare an economic strategy for you. This is provided to you at one more conference in a paper called a Declaration of Recommendations (SOA). Ask the advisor to explain anything you do not comprehend. You should constantly really feel comfy with your advisor and their guidance.

Firmly insist that you are informed of all deals, and that you obtain all correspondence pertaining to the account. Your advisor might suggest a taken care of discretionary account (MDA) as a means of managing your investments. This involves authorizing a contract (MDA agreement) so they can purchase or offer financial investments without having to talk to you.

Clark Wealth Partners - The Facts

To protect your money: Don't give your advisor power of attorney. Urge all communication concerning your investments are sent to you, not just your consultant.

If you're moving to a brand-new consultant, you'll need to arrange to move your monetary records to them. If you need assistance, ask your adviser to explain the process.

To load their shoes, the country will certainly require even more than 100,000 brand-new economic advisors to get in the market.

The 45-Second Trick For Clark Wealth Partners

Assisting people accomplish their economic objectives is a financial consultant's key function. They are likewise a little business proprietor, and a section of their time is dedicated to managing their branch office. As the leader of their practice, Edward Jones economic consultants need the leadership skills to hire and manage team, in addition to business acumen to produce and perform an organization technique.

Spending is not a "set it and neglect it" task.

Financial experts need to set up time weekly to fulfill brand-new people and capture up with the individuals in their ball. The financial services industry is greatly controlled, and regulations transform commonly - https://hub.docker.com/u/clrkwlthprtnr. Several independent economic experts spend one to 2 hours a day on compliance activities. Edward Jones financial consultants are lucky the office does the hefty lifting for them.

An Unbiased View of Clark Wealth Partners

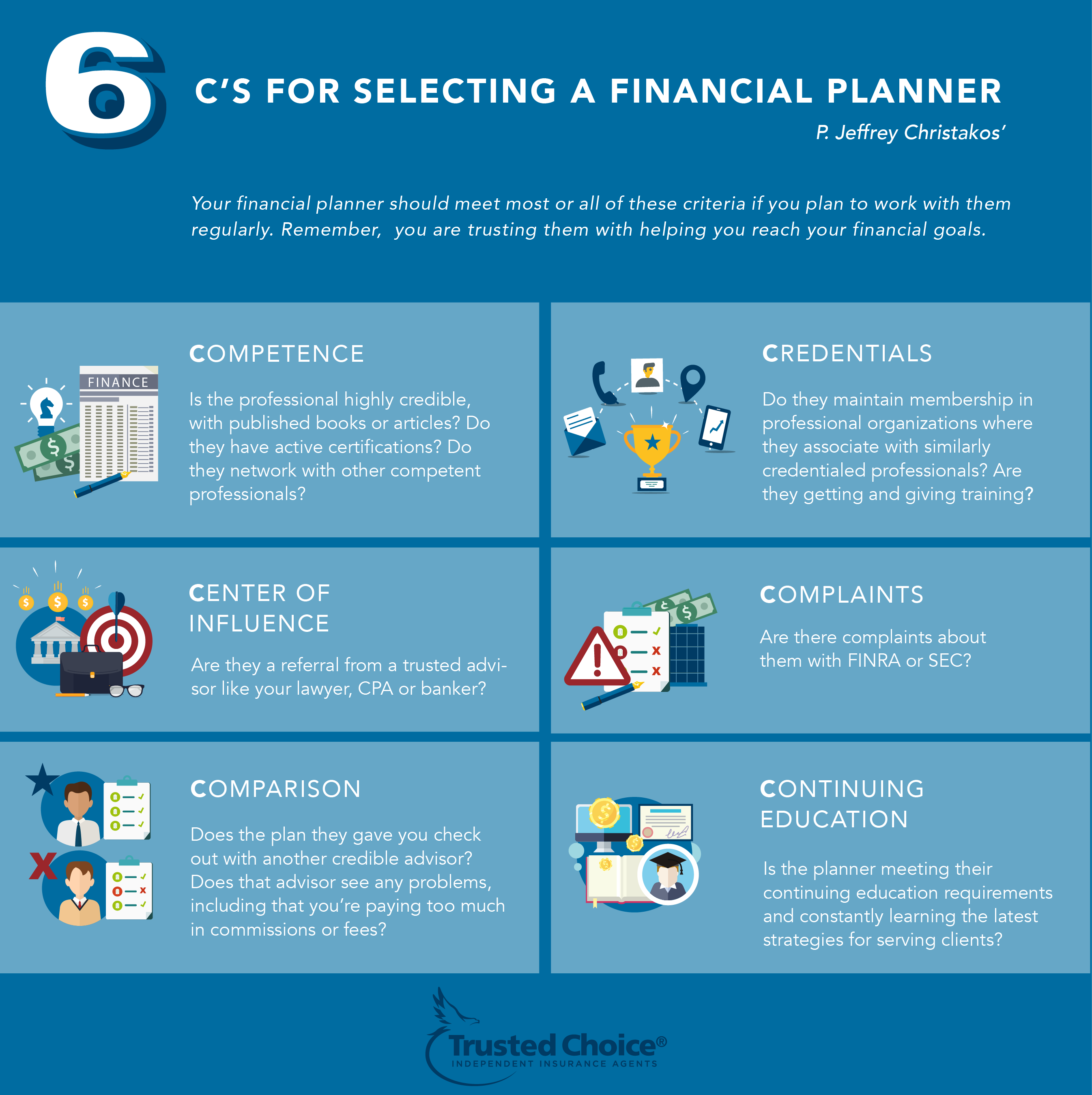

Continuing education and learning is a needed component of keeping a moved here financial expert certificate (financial advisors Ofallon illinois). Edward Jones economic advisors are encouraged to pursue extra training to broaden their knowledge and abilities. Commitment to education protected Edward Jones the No. 17 place on the 2024 Educating pinnacle Honors checklist by Educating publication. It's also an excellent idea for monetary consultants to participate in sector meetings.